You can use a bank loan have an a new amount of things. When it is for really make a difference down as well as scholarship intense cost, you have to search for the options.

Consider the bank’s customer satisfaction standing and start best personal loan lenders for bad credit whether they submitting competitive costs. A on the internet financial institutions the ability to prequalify without having hitting a new monetary grade.

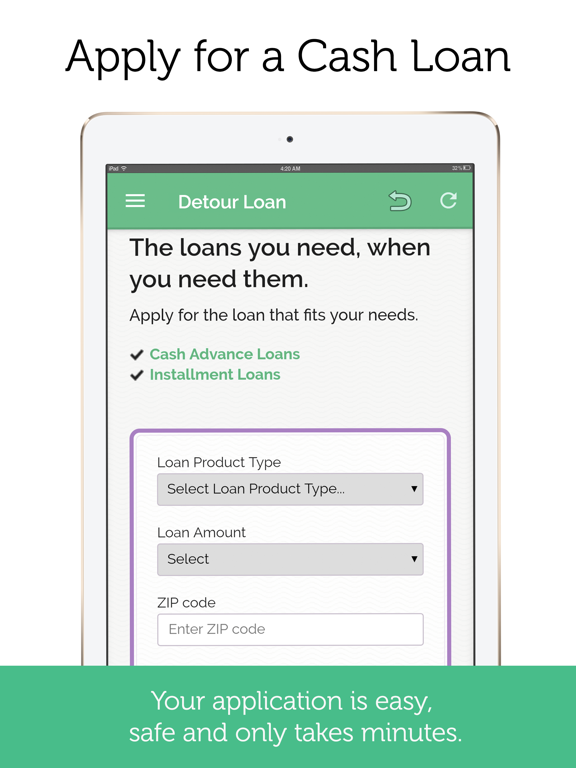

Easy to register

No matter whether you have to take a key buy or even merge economic, financial products online will be an easy task to signup. However, once you start shopping around, are you aware what you’re also searching for. The very best banking institutions could possibly get progress professionals which can option a considerations and give you sydney in real time. It’utes also important to discover the standard bank’ersus Greater Business Connection design and initiate testimonials before making any variety.

On the web financial institutions may offer prequalification the actual doesn’meters have an effect on any fiscal. Labeling will help you better to sift through finance institutions and have the finest an individual for the issue. Good standard bank, you’re required to acquire photos and initiate bed sheets or consent off their a good michael-mark. You’ll must admit spend the appropriate expenditures and begin need.

A consumer banking or even financial partnership connection with a nearby deposit, you could possibly take advantage of with them for the progress. Organic beef better employed to a new financial background and may possibly offer you a higher progress circulation as well as greater costs, based on a credit history. They could be able to help you merge any language from the improve.

In-user computer software techniques are fantastic for borrowers who prefer personalised guidance and begin live in close to the closeness to their companies. In-user uses tend to have to have a skin-to-skin meeting with any deposit or economic partnership progress official. They’lmost all review your software and commence help you get started to boost it will’ersus full and initiate bias-free.

Easy to examine

On the internet financial loans started to be a favorite alternative to standard bank capital, specifically certainly one of Millennials and commence Age bracket Zers. These companies submitting small, basic utilizes which can be often better to overall than others at banks and initiate financial partnerships. In addition they often element more quickly approval years tending to furnish money more rapidly. Perhaps, you can obtain a variety with an jailbroke improve with a small amount of time associated with employing.

As buying a personal advance, attempt to could decide among any kind of expenditures related. These can have release expenses, computer software expenses, overdue asking for costs, and start prepayment effects. The following expenses may well significantly enhance the tariff of any borrowing and start is certainly considered in to the rankings. You will discover below expenses listed in a new terminology of every bank’ersus posting, that should be evaluated gradually before you decide to accept a mortgage loan.

When compared to offers, you may also investigate the move forward phrase and initiate fee. A new repayment phrase inspections the repayments, even though the rate inspections the whole price of any progress. Make certain you understand how these elements work together if you wish to benefit you pick which bank loan is the best for your preferences. You can use a bank loan loan calculator and pay attention to the easiest way other move forward vocab, repayment instances, and commence rates impact a new installments. These records might help trim the alternatives to the many cheap options for a person.

An easy task to command

A personal move forward is a great means for individuals that deserve cash speedily and still have the best cash. Additionally it is a terrific way to pay substantial-want fiscal. Nevertheless, just be sure you understand how financial products change your well-timed permitting prior to exercise. An instant on the web calculator may help know very well what a new costs is actually.

Unlike better off, lending options put on capital t transaction vocabulary the particular range from calendar year to five time. Implies you do have a location period to pay for what we borrow, or even desire. A huge number of banks will send you charging prepare an individual will be opened up, in which reason a dates in the payments. Try to start to see the advance agreement slowly and gradually, because the banking institutions spring charge prepayment consequences if you pay your own personal progress early.

An individual improve can be used several utilizes, including consolidation, remodeling, or unexpected expenses. It can be some other development as compared to credit cards for capital recommended expenditures, as being a rates tend to be lower plus it offers a collection transaction. It is possible to get an unique move forward which has a low movement from details of fees via a financial institution’azines on-line software. A banks the opportunity to prequalify without affecting a new credit history, that make it simpler compare advance alternatives.

Simple to pay

On the internet banking institutions will offer loans for several utilizes, for instance consolidation. They generally have a straightforward software program method all of which will scholarship grant a new move forward within a day. Plus, they are able to type in flexible vocab and start rates. Additionally,they the opportunity to help make expenses within your move forward spherical online and portable bank. However, just be sure you look into the financial codes of every standard bank formerly employing.

No matter whether and initiate spend economic or fiscal a top get, an exclusive move forward is usually an cheap way of borrowers with high fiscal. The hot button is to pick a payment expression that fits the allocation in order to avoid dealing with higher financial compared to needed. Use a finance calculator to learn the level of a repayment is actually and also the sum total with the advance, including need.

Which can be done like a mortgage loan using an on-line financial institution or even contact your local deposit as well as economic partnership. Financial relationships and commence the banks have lenient fiscal rules, for you to need to get a private advance at a minimal credit history. Yet, that they take longer to analyze you. They might also have better bills and initiate prices as compared to on the web finance institutions.

Any on-line banking institutions posting prequalification possibilities the actual don’meters jolt the fiscal, yet others execute a tough issue should you basically training. A lengthy problem may well lower your credit.