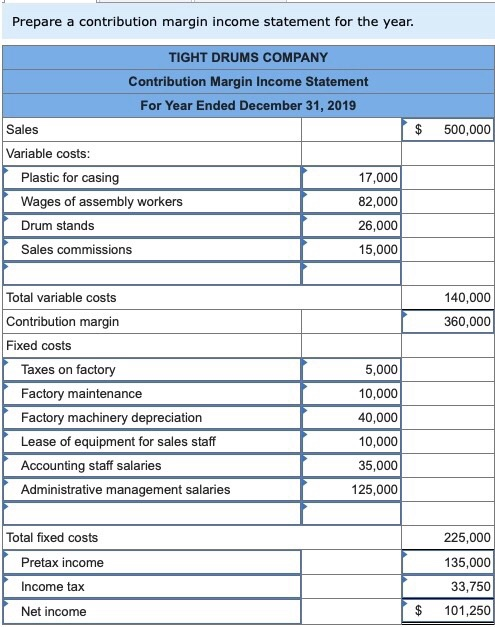

In its simplest form, a contribution margin is the price of a specific product minus the variable costs of producing the item. What’s left is the contribution margin, which gives a sense of how much is left over to cover fixed expenses and make a profit. A contribution margin income statement is a document that tallies all of a company’s products and varying contribution margins together, helping leaders understand whether the company is profitable. It’s a useful tool for making decisions on pricing, production, and anything else that could improve profitability. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.

How do you calculate the contribution margin from EBIT?

Let’s dive into how variable costs affect something called the contribution margin. This is a big deal for any business because it helps them figure out how much money they can make after paying for the costs that change. Imagine you have a lemonade stand; the more lemonade you sell, the more sugar and cups you need. These are your variable costs because they go up or down based on how much lemonade you sell. You need to calculate the contribution margin to understand whether your business can cover its fixed cost. Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits.

Sales Revenue

Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. Management should also use different variations of the CM formula to analyze departments and product lines on a trending basis like the following. To illustrate the concepts of contribution margin, consider the following example. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax’s permission. Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

How do you calculate EBIT and EBITDA on an income statement?

This helps the business make smart decisions about pricing, what to sell, and how to manage costs. Once you have calculated the total variable cost, the next step is to calculate the contribution margin. The contribution margin is the difference between xero spruces up starter plan to help support small businesses total sales revenue and the variable cost of producing a given level of output. In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\).

- To get the contribution margin, you subtract these costs from the product’s revenue.

- The same will likely happen over time with the cost of creating and using driverless transportation.

- To illustrate the concepts of contribution margin, consider the following example.

- These core financial ratios include accounts receivable turnover ratio, debts to assets ratio, gross margin ratio, etc.

Use of Contribution Formula

Sales revenue refers to the total income your business generates as a result of selling goods or services. Furthermore, sales revenue can be categorized into gross and net sales revenue. Fixed costs are the costs that do not change with the change in the level of output. In other words, fixed costs are not dependent on your business’s productivity.

If you’re serious about safeguarding your business’s finances, you need to get into the granular details of your profitability—and that means producing quality contribution margin income statements. The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability.

If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\). If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

These costs are important because they directly affect how much money a business can make from selling its products. For instance, if the costs of sugar and cups for your lemonade stand go up, you’ll have less money left over from each sale. This is crucial for a business to understand because it helps them see which products are really making money and which might be losing money. It shows the percentage of sales revenue that ends up as profit after all expenses are paid. This includes every cost, from making the product to the company’s rent and advertising.

We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will manage your bookkeeping and file taxes for you. Furthermore, this ratio is also useful in determining the pricing of your products and the impact on profits due to change in sales. Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. Taxes and other company expenses can obscure how well a company’s products or services perform.

As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. The contribution margin income statement is a special format of the income statement that focuses on bifurcated expenses for better understanding. Looking at this statement, it can be easily understood as to which business activity is resulting in a revenue leak.

So, you should produce those goods that generate a high contribution margin. As a result, a high contribution margin would help you in covering the fixed costs of your business. If we subtract the variable costs from the revenue, we’re left with a $22,000 contribution margin. In a different example than the previous one, if you sold 650 units in a period, resulting in $650,000 net profit, your revenue per unit is $1,000. If variable expenses were $250,000, so you’d have $385 in variable expenses per unit (variable expenses÷units sold).

0 responses on "Contribution Margin Ratio: Definition, Formula, and Example"