This means management needs to run two sets of forecasts, before and after management’s plans, whereas IFRS Standards are not prescriptive in this regard. In our experience, if there are such material uncertainties then a company usually provides disclosure as part of the basis of preparation note in the financial statements. Auditors are required by ISA 315, Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment, to gain an understanding of the audit client’s business and the economic environment in which it operates. This understanding should then lead to the identification of business risks, which are then evaluated in terms of any risks of material misstatement in the financial statements. IAS 1 required management to assess whether their company is able to run for the foreseeable period or not.

How a going concern qualification affects a business

A company or investor that is acquiring a company may compare that company’s going-concern value to its liquidation value in order to decide whether it’s financially worthwhile to continue operating the company, or whether it is more profitable to liquidate it. In order to assume that the entity has no going concern problem, the managements have to perform the proper assessment by including all relevant indicators that could cause the entity to close its business in the next twelve months period. In accounting, going concerned is the concept that the entity’s Financial Statements are prepared based on the assumption that the entity operation is still operating normally in the next foreseeable period. This foreseeable period normally has twelve months from the ending period of Financial Statements.

What is your current financial priority?

The going concern concept accounting reveals the true financial integrity of an organization. It is an action an organization conducts to ensure a clearer picture of their financial and growth related concerns. The business’s financials should speak how should i record my business transactions about the industry’s sustainability through top-line and bottom-line growth and higher operating and Net profit margin. – In 2011, Gibson Guitar Factory was raided by the Federal government for illegally smuggling endangered wood into the country.

Which of these is most important for your financial advisor to have?

An entity is assumed to be a going concern in the absence of significant information to the contrary. An example of such contrary information is an entity’s inability to meet its obligations as they come due without substantial asset sales or debt restructurings. If such were not the case, an entity would essentially be acquiring assets with the intention of closing its operations and reselling the assets to another party. The going concern principle is the assumption that an entity will remain in business for the foreseeable future.

Get in Touch With a Financial Advisor

- If substantial doubt is raised, management then assesses whether that substantial doubt is alleviated by management’s plans.

- A small business cannot make payments to its creditors due to an extremely poor liquidity position.

- In addition, economic recessions are crucial, which determine management’s ability when major firms fail to generate profits.

- The entire concept of depreciating and amortizing assets is based on the idea that businesses will continue to operate well into the future.

- A business runs on the going concern basis of the products/services offered to the consumers.

The assessment typically requires significant judgment.COVID-19 impact on the assessment. The going-concern value of a company is typically much higher than its liquidation value because it includes intangible assets and customer loyalty as well as any potential for future returns. The liquidation value of a company will even be lower than the value of the company’s tangible assets, because the company may have to sell off its tangible assets at a discount—often, a deep discount—in order to liquidate them before ceasing operations. Examples of tangible assets that might be sold at a loss include equipment, unsold inventory, real estate, vehicles, patents, and other intellectual property (IP), furniture, and fixtures. Business risks include risks that could reduce the company’s profit and/or cash inflows, and could ultimately mean that either a company is not a going concern, or that there are significant doubts over its ability to continue as a going concern.

The Federal government took more than $250,000 worth or Gibson’s inventory and slapped them with large fines for violating international laws. Gibson is still considered a going concern, because it is not likely the fines and punishment will stop its operations. – Assume Microsoft is currently suing a small tech company for copyright violation over its software package. Since this software package is the only operation the small tech company does, losing this lawsuit would be detrimental.

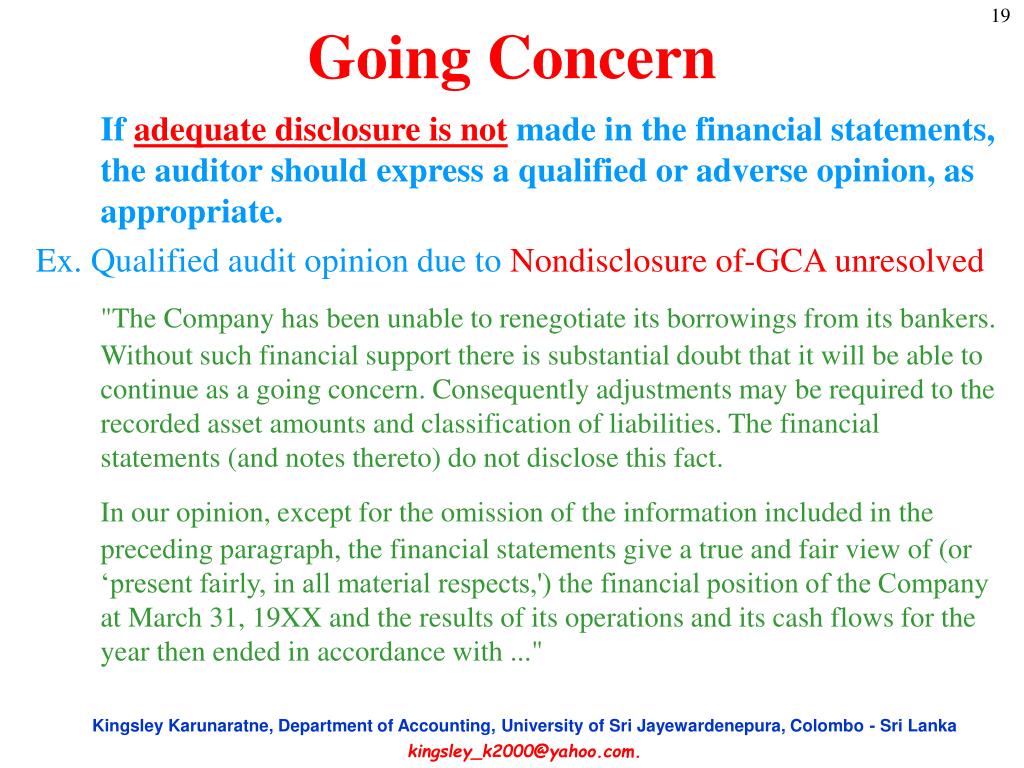

The Material Uncertainty Related to Going Concern section will follow the Basis for Opinion paragraph and will cross-reference to the relevant disclosure in the financial statements. It will also state that the auditor’s opinion is not modified in respect of this matter. When faced with such a requirement, candidates must be careful not to produce a list of generic audit procedures, but instead identify and highlight the factors from the scenario that may call into question the entity’s ability to continue as a going concern.

In May 2014, the Financial Accounting Standards Board determined financial statements should reveal the conditions that support an entity’s substantial doubt that it can continue as a going concern. Statements should also show management’s interpretation of the conditions and management’s future plans. So, if December 31, 2017, financial statements (for a nonpublic company) are available to be issued on March 15, 2017, the preparer looks forward one year from March 15, 2017. Then, the preparer asks, “Is it probable that the company will be unable to meet its obligations through March 15, 2018?

Management needs to evaluate whether it has adequate processes and internal controls in place to comply with the going concern evaluation requirements. In changing economic environments, management may need to change its current processes and controls or implement new processes and controls to account for the impacts new economic adversities can raise. The going concern standard requires management to make a reasonable effort to identify these conditions and events. Management will need to determine whether it can do this assessment using its current processes and controls or whether it needs to modify its processes and controls or implement new ones. Particularly in adverse economic environments, the going concern evaluation could be a significant undertaking for management. If conditions are changing rapidly, management’s evaluation may need to be updated frequently up through the date of issuance of the related financial statements.

As you would expect, the answer to this question determines whether going concern disclosures are to be made and what should be included. Candidates attempting AA will need to have a sound understanding of the concept of going concern. Among other syllabus requirements, candidates must ensure they are aware of the respective responsibilities of auditors and management regarding going concern. The provisions in ISA 570, Going Concern deal with the auditor’s responsibilities in relation to management’s use of the going concern basis of accounting in the preparation of the financial statements.

0 responses on "What is Going Concerned? Definition, Assessment, Indicators, Example, Disclosure"